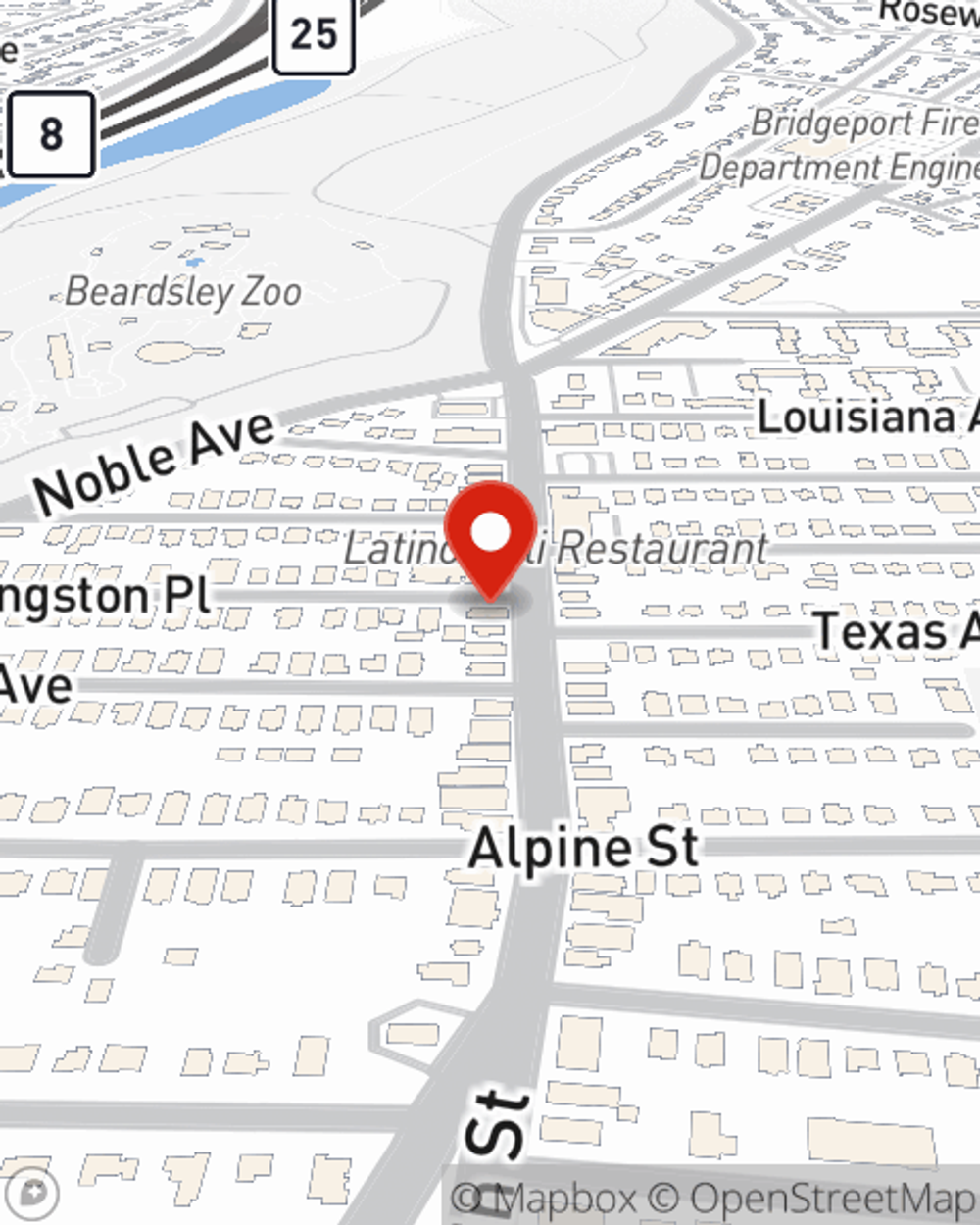

Business Insurance in and around Bridgeport

Calling all small business owners of Bridgeport!

No funny business here

This Coverage Is Worth It.

Running a small business is hard work. Getting the right insurance should be the least of your worries. State Farm insures small businesses that fall under the umbrella of retailers, contractors, trades and more!

Calling all small business owners of Bridgeport!

No funny business here

Cover Your Business Assets

Your business is unique and faces specific challenges. Whether you are growing a clock shop or a shoe repair shop, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your layout, you may need more than just business property insurance. State Farm Agent Chris Boyle can help with a surety or fidelity bond as well as commercial auto insurance.

The right coverages can help keep your business safe. Consider calling or emailing State Farm agent Chris Boyle's office today to review your options and get started!

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Chris Boyle

State Farm® Insurance AgentSimple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.